Gcash Swift Code: Your Ultimate Guide to International Transfers

Are you looking to send or receive money internationally using GCash and wondering about its Swift Code? You've come to the right place! We know how confusing international transfers can be, especially when you're dealing with digital wallets. Let's demystify the GCash Swift Code together and ensure your money gets where it needs to go without a hitch.

GCash has become an indispensable part of daily life for many Filipinos, from paying bills to sending money locally. But when it comes to global transactions, things can get a little tricky. Understanding the role of a Swift Code is crucial, and we're here to break it down for you in simple terms.

What Exactly is a Swift Code and Why Does GCash Need One?

First things first, let's talk about Swift Codes. A Swift Code, also known as a BIC (Bank Identifier Code), is a unique identification code for a specific bank or financial institution worldwide. It acts like an international address, ensuring that your money is sent to the correct bank and branch when making cross-border transactions.

When you initiate an international wire transfer, the sender's bank uses this code to route the funds correctly. Without it, your money could end up in the wrong place, or the transaction might fail altogether. So, it's pretty important!

Finding the Right GCash Swift Code: It's Not as Simple as You Think!

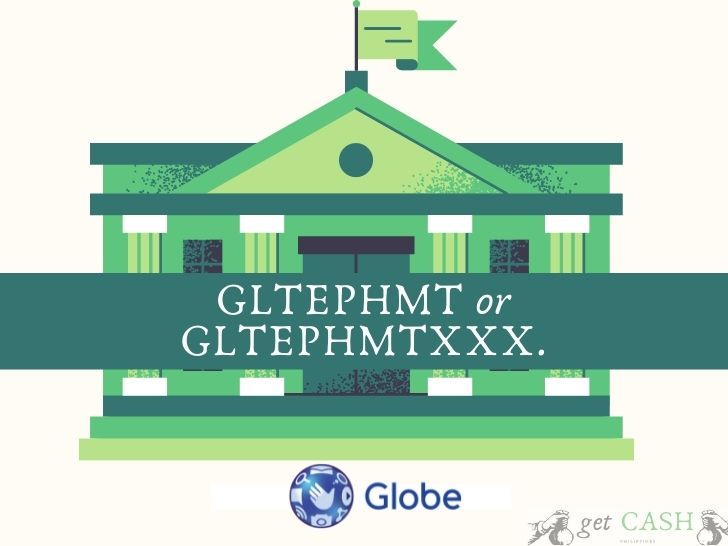

Here's the twist: GCash itself, being an e-wallet and not a traditional bank, doesn't have its own unique Swift Code. This is a common point of confusion for many users. Instead, GCash relies on its partner banks and remittance services for international transactions.

This means that if you're trying to receive money from abroad into your GCash account, the Swift Code you'll need isn't for GCash directly. It will depend on the specific method or partner bank the sender uses to transfer funds.

Common Scenarios and Their Corresponding Swift Codes

Let's look at a few common ways you might receive money from overseas that can end up in your GCash wallet, and what Swift Codes might be involved:

- Receiving Money via Bank Transfer: If someone sends money directly to a Philippine bank account that you then transfer to GCash, or if a service partner uses a bank, you'll need that bank's Swift Code. Some common ones include:

- BPI (Bank of the Philippine Islands): BOPIPHMM

- UnionBank of the Philippines: UBPHPHMM

- Metrobank: MBTCRUMM

- RCBC (Rizal Commercial Banking Corporation): RCBCPHMM

Remember, for these, the sender will transfer to your bank account, and you'll then cash-in to GCash from there.

- Using GCash for Cash-in via Remittance Partners (e.g., Western Union, MoneyGram, Remitly): For these services, the sender typically initiates the transfer through the remittance partner's platform. They don't usually require a Swift Code for your GCash account.

Once the money is sent, you, the recipient, can then open your GCash app and use the "Cash-in" feature, selecting the specific remittance partner (e.g., Western Union) to claim and receive the funds directly into your GCash wallet. This is usually the simplest method!

Step-by-Step Guide to Receiving International Remittances via GCash

So, how do you actually get money from abroad into your GCash account? Here's a general guide:

- Inform the Sender: Tell the person sending you money that you wish to receive it via GCash.

- Choose a Remittance Partner: The sender will need to use a remittance service that partners with GCash (like Western Union, MoneyGram, Remitly, etc.).

- Sender Initiates Transfer: The sender will go to their chosen remittance partner (online or in-person) and send money to the Philippines, typically providing your full name and GCash-registered mobile number.

- Receive Transaction Details: The sender will then give you a reference number (MTCN for Western Union, KPTN for MoneyGram, etc.). This is vital!

- Cash-in via GCash App: Open your GCash app, tap "Cash In," and select "Remittance" or the specific partner.

- Enter Details: Input the reference number and the exact amount sent.

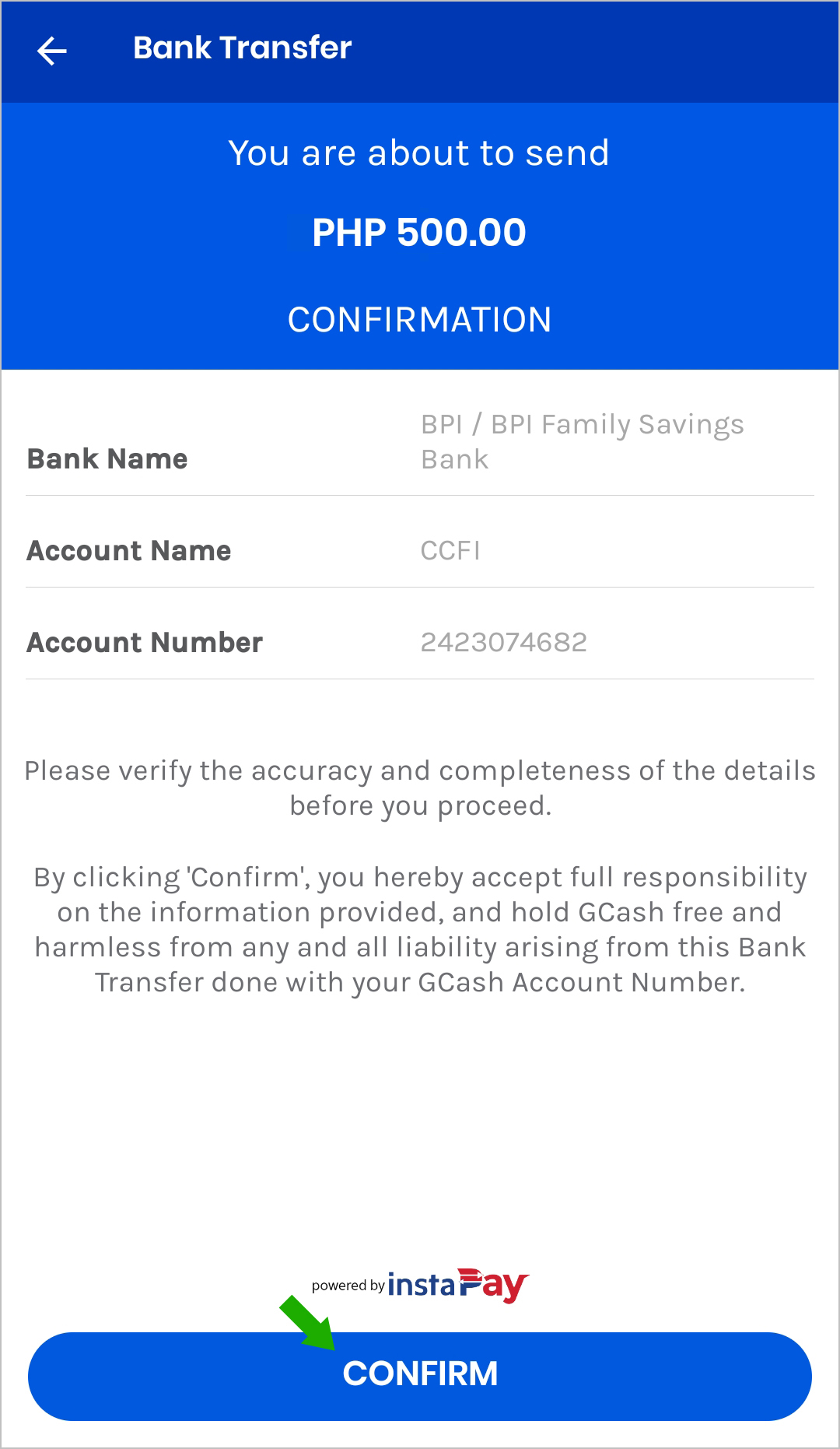

- Confirm and Receive: Review the details and confirm. The funds should then be credited to your GCash wallet instantly or within minutes!

Important Reminders Before Making a Transaction

To ensure a smooth transaction and avoid any headaches:

- Double-Check Details: Always confirm the recipient's name, GCash-registered number, and transaction reference number.

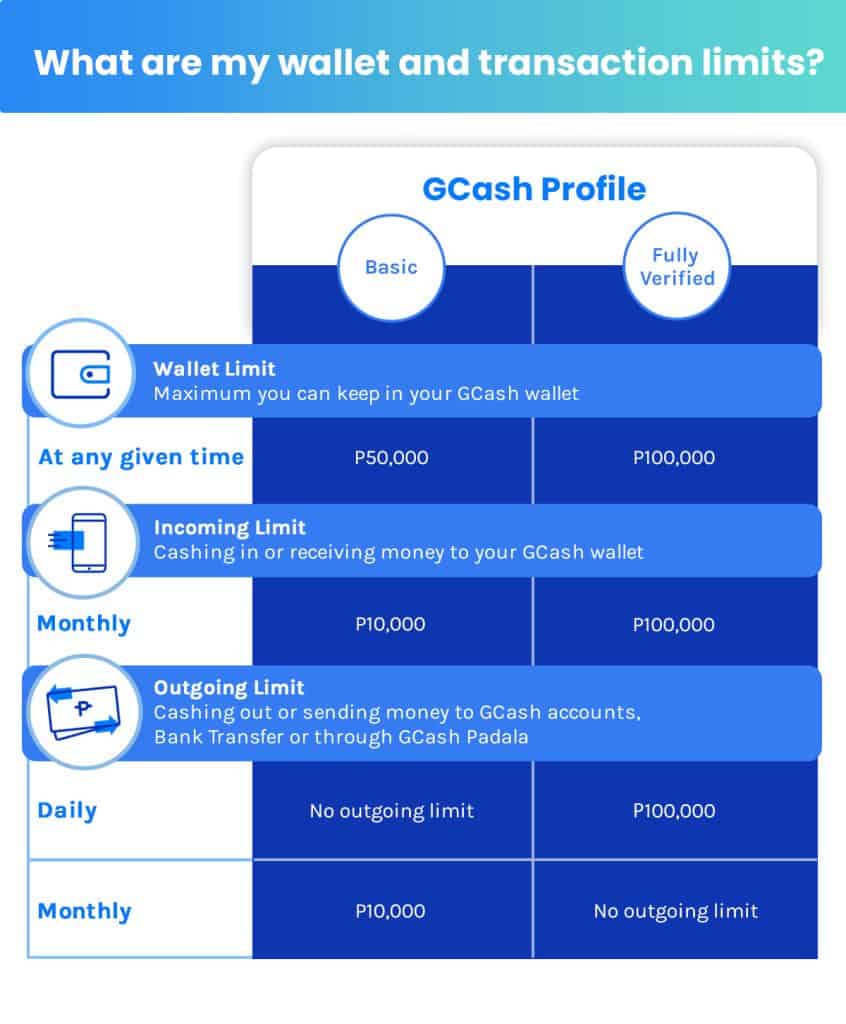

- Transaction Limits: Be aware of GCash daily and monthly transaction limits. Ensure the amount you're expecting falls within these limits.

- Fees and Exchange Rates: Both the sender and receiver should be aware of any fees charged by the remittance service and the applicable exchange rates.

- Security: Never share your GCash MPIN or OTP with anyone.

- Contact Support: If you encounter any issues, reach out to GCash customer service or the specific remittance partner.

Conclusion

While GCash doesn't have its own specific Swift Code, understanding its role as an e-wallet and how it integrates with partner banks and remittance services is key. For most international transfers directly into your GCash account, you'll be using the "Cash In via Remittance" feature, which usually just requires a reference number from the sender. If you're receiving money via a traditional bank transfer that you'll then move to GCash, you'll need that specific bank's Swift Code. Always clarify the method with your sender to ensure a smooth and successful transaction!

FAQ (Frequently Asked Questions)

- Can I directly use a Swift Code to send money to a GCash account?

- No, you cannot directly use a Swift Code to send money to a GCash account because GCash does not have its own Swift Code. Swift Codes are for traditional bank-to-bank transfers. For GCash, you typically use remittance partners.

- What information does the sender need to send money to my GCash?

- The sender generally needs your full name (as registered with GCash) and your GCash-registered mobile number. They will use a third-party remittance service (like Western Union, MoneyGram, Remitly, etc.) to initiate the transfer.

- Is it safe to receive international remittances via GCash?

- Yes, receiving international remittances via GCash through its official remittance partners is generally safe. Always ensure you are using the legitimate GCash app and verified remittance services, and never share your sensitive account details like MPIN or OTP.

- Are there fees for receiving international remittances in GCash?

- While GCash usually doesn't charge a fee to the recipient for receiving remittances, the sender might incur fees from their chosen remittance service. Exchange rates also apply, which may differ between services.

Gcash Swift Code

Gcash Swift Code Wallpapers

Collection of gcash swift code wallpapers for your desktop and mobile devices.

Mesmerizing Gcash Swift Code Moment Illustration

Transform your screen with this vivid gcash swift code artwork, a true masterpiece of digital design.

Mesmerizing Gcash Swift Code Landscape Illustration

Transform your screen with this vivid gcash swift code artwork, a true masterpiece of digital design.

High-Quality Gcash Swift Code Landscape for Desktop

Transform your screen with this vivid gcash swift code artwork, a true masterpiece of digital design.

Vibrant Gcash Swift Code Capture Illustration

Explore this high-quality gcash swift code image, perfect for enhancing your desktop or mobile wallpaper.

Lush Gcash Swift Code Landscape Concept

Find inspiration with this unique gcash swift code illustration, crafted to provide a fresh look for your background.

Exquisite Gcash Swift Code Capture for Your Screen

A captivating gcash swift code scene that brings tranquility and beauty to any device.

Amazing Gcash Swift Code Background Digital Art

Experience the crisp clarity of this stunning gcash swift code image, available in high resolution for all your screens.

Beautiful Gcash Swift Code Picture for Mobile

Explore this high-quality gcash swift code image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Gcash Swift Code Landscape for Desktop

A captivating gcash swift code scene that brings tranquility and beauty to any device.

Dynamic Gcash Swift Code Design in 4K

A captivating gcash swift code scene that brings tranquility and beauty to any device.

Detailed Gcash Swift Code Artwork for Mobile

Discover an amazing gcash swift code background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Gcash Swift Code Landscape Concept

Transform your screen with this vivid gcash swift code artwork, a true masterpiece of digital design.

Beautiful Gcash Swift Code Abstract for Your Screen

Explore this high-quality gcash swift code image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Gcash Swift Code Design Digital Art

Find inspiration with this unique gcash swift code illustration, crafted to provide a fresh look for your background.

Exquisite Gcash Swift Code Picture for Your Screen

Immerse yourself in the stunning details of this beautiful gcash swift code wallpaper, designed for a captivating visual experience.

Vibrant Gcash Swift Code Background for Desktop

Explore this high-quality gcash swift code image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Gcash Swift Code Picture in 4K

Experience the crisp clarity of this stunning gcash swift code image, available in high resolution for all your screens.

Crisp Gcash Swift Code Abstract Illustration

Immerse yourself in the stunning details of this beautiful gcash swift code wallpaper, designed for a captivating visual experience.

Crisp Gcash Swift Code Design Photography

Immerse yourself in the stunning details of this beautiful gcash swift code wallpaper, designed for a captivating visual experience.

Artistic Gcash Swift Code Image Art

A captivating gcash swift code scene that brings tranquility and beauty to any device.

Download these gcash swift code wallpapers for free and use them on your desktop or mobile devices.